Treasuries were little changed, with 10-year yields near the highest level in four months, on concern the government’s final figure for third-quarter gross domestic product will add to fears inflation is poised to accelerate.

The yield curve, the gap between shorter- and longer-term debt used as a barometer for the economy, yesterday widened to a record as investors bet an accelerating recovery will fuel inflation and hurt demand for unprecedented government debt sales.

Government securities may extend yesterday’s losses, the largest drop since August, before the US tomorrow announces the sizes of two-, five- and seven-year auctions next week.

Source: Bloomberg

Source: Bloomberg

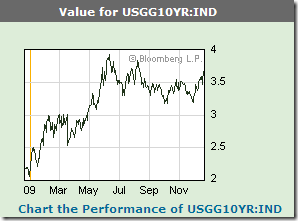

The benchmark 10-year note (see the above graph) yielded 3.67 percent as of 9:17 a.m. Tokyo.

The difference between 2- and 10-year Treasury note yields increased to as much as 282 basis points yesterday.

It rose from 145 basis points at the beginning of the year, with the Federal Reserve anchoring its target rate at virtually zero and the US extending the average maturity of its debt.

The yield curve reached its previous record of 281 basis points on June 5, when Treasuries plunged after a government report showed the smallest decline in US payrolls in eight months. Ten-year note yields touched 4 percent the following week, the highest level in 2009.

We are waiting now the Commerce Department report for GDP and also consumer spending, the latter being expected to raise by 0.7%.

If productivity is unchanged, I am sure that US will face inflation pressure.

Mots clés Technorati : American Economy,Inflation,fvtaiwan

No comments:

Post a Comment